The Indian stock market has come a long way from its beginnings. From traditional brokers who started with paperwork to today’s digital trading. Dhan has joined this race.

In this blog, we will examine Dhan deeply, and explore its features and benefits. We will also see which of its features sets it apart from the crowd of Indian stock market brokers. Whether you are a part-time trader or preparing to take a deep plunge into the stock market, we will explain how much Dhan can help you on this journey.

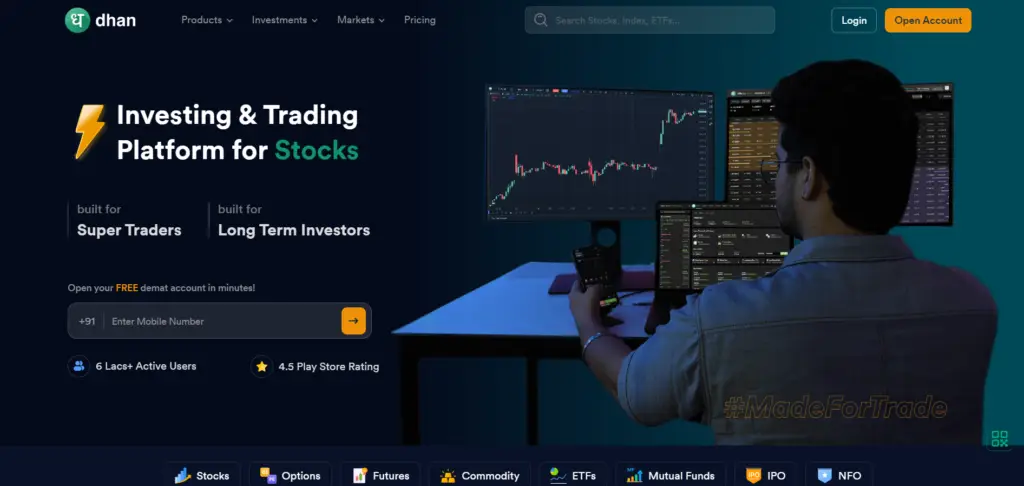

What Is Dhan?

As we all know, Dhan is a new name in stock broking. It was created to simplify trading and investing for the new generation.

The Basis Of Dhan

Dhan is a digital stock broking platform that helps users buy and sell stocks, commodities, derivatives, and other instruments. Dhan provides beginners and experienced traders with different tools and features that support their trading style and help them achieve their financial goals.

Delivering a better user experience with the help of technology sets Dhan apart from others. For example, advanced charting tools and quick order execution.

Team Behind Dhan

CEO and founder of Dhan: Mr Praveen Jadhav (Ex- CEO of PayTM Money)

Key Features Of Dhan

Let us know about some key features that make Dhan stand out from the crowd of stockbrokers in the Indian stock market.

User-friendly interface

The interface of Dhan is clean and easy to navigate the platform, which even beginners can use. From account opening to order placing, everything is streamlined and straightforward.

Advanced trading tools

There are some trading tools of Dhan that are helpful for market analysis for experienced traders.

Advanced charting tools

Technical indicators

Options analysis

Screener

Heatmap

With the help of all these tools, deep analysis can be done which helps in taking better trades.

- Rapid order execution

Dhan is one of the fastest trade-executing brokers. Speed is very important in intraday trading and F&O trading.

- Multi-device accessibility

The platform is accessible to multiple devices such as desktops, laptops, tablets and mobiles. Its mobile app is known for its functionality and ease of use.

- Research and analysis

Their tools help in both technical and fundamental analysis. So that you can make short-term trading decisions along with long-term investment.

How to get started with Dhan

1.Account opening

Opening an account with Dhan is the first step to enter the world of trading. The entire process is digital, which can be completed in a few minutes. Complete the KYC (know your client) process by providing basic personal information. In this, submit identity and address proof.

2.Funding your account

Once you set up and activate your account, you can transfer funds into it. Dhan gives you many options to transfer funds, such as net banking through NEFT/RTGS transfer and UPI. It is completely secure and funds reflect quickly on your screen.

3.Exploring the platform

Before you start trading, it is important to get familiar with the platform to avoid manual errors during order placement. Take your time to explore its features and tools. Dhan offers demo videos and tutorials that help beginners to get acquainted with the platform.

4.Making your first trade

When you feel comfortable with the platform, you can take your first trade. You can buy stock, take a position in F&O or explore mutual funds.

The pricing structure of Dhan.

Trading cost makes a big difference in choosing a broker. Let us know about Dhan’s fee structure and charges.

Brokerage fees

Dhan doesn’t charge for equity delivery and mutual fund orders.

It charges Rs20 per F&O or intraday equity trade or 0.03% of turnover whichever is lower.

Account maintenance charge

Dhan does not charge for account maintenance. This is valuable for saving cost who do not trade frequently.

Other charges

There are some regulatory charges which are levied on every broker. This includes STT (Securities Transaction Tax), SEBI turnover charges, stamp duty and GST. All this is displayed transparently, giving the trader a clear idea of the fee structure.

Dhan vs traditional brokers

There are some key features that differentiate Dhan from other brokers.

Cost structure

The fee structure of traditional brokers is complex. Dhan has a flat fee structure and transparency makes it easy for traders to calculate their costs.

Speed of execution

Dhan provides faster trade execution than traditional brokers, which is very important in fast-moving markets.

Research and analysis

Dhan provides all the tools that help in technical and fundamental analysis.

Fast withdrawal system

Dhan has developed a fast withdrawal system which can be very useful in an emergency.

Pros and cons of using Dhan

It is important to know the pros and possible drawbacks of Dhan before taking the service. Here you will get to know the pros and cons of Dhan.

Pros of using Dhan

User-friendly interface

Advanced trading tools

Competitive price with a transparent fee structure

Fast order execution

Robust mobile app

No account maintenance charges

Comprehensive research and analytic tools

Supports Algo trading

Potential cons of using Dhan

Dhan does not have a longstanding reputation like older brokers.

Some investors may need in-person services for their investment decisions that Dhan is not offering.

Is Dhan right for you?

Any service depends on personal preferences. Let’s see to whom Dhan might suit.

For new investors

Dhan’s user-friendly interface and educational resources can offer a lot to beginners.

For tech-savvy traders

If you are a tech lover and want to manage your portfolio yourself, Dhan’s digital platform can be helpful to you.

For active traders

Dhan’s advanced trading tools and fast execution speed are perfect for active traders who want fast order execution by making quick decisions.

For cost-conscious investors

If you want to minimize trading costs, Dhan’s competitive pricing and no annual maintenance charge are your cup of tea.

Where does Dhan stand in the future of stock broking?

Digital platforms like Dhan play an important role in the Indian stock market. The cost-effectiveness, speed and convenience of brokers like Dhan is pushing the stockbroker industry for innovation. Dhan is fulfilling the requirements of both new traders and experienced traders in a good manner, due to which there is an excellent possibility of its survival in the future. The field of stock broking is very competitive to survive in it. Dhan will have to keep making improvements in the offering along with new innovations so that Dhan’s position continues.

Is Dhan the future of Indian stock broking

So far, from what we have seen, Dhan stands tall in whatever broking facility an Indian investor needs. Its user-friendly design, advanced trading tools, competitive pricing, and focus on technology make it a strong contender in Indian stock broking.

But whether Dhan is right for you or not depends on your personal needs and investment style. It is always better to research all the options first and choose the right broker.

It is clear that Dhan is a new breed of stockbroker. We hope that with the evolving stock market, Dhan itself will evolve too.

You can be a part-time trader or a full-time trader or even a beginner, Dhan provides all the features and tools that you can consider.

Dhan is a part of this changing Indian stockbroking world. Only time will tell whether Dhan will be able to maintain its position in the future or not.